Biography

Jeremy Siegel is the Russell E. Palmer Professor of Finance at the Wharton School of the University of Pennsylvania. He graduated from Columbia University in 1967, received his Ph.D. in Economics from the Massachusetts Institute of Technology in 1971, and spent one year as a National Science Foundation Post-Doctoral Fellow at Harvard University. Prof. Siegel taught for four years at the Graduate School of Business of the University of Chicago before joining the Wharton faculty in 1976.

Prof. Siegel has written and lectured extensively about the economy and financial markets, has appeared frequently on CNN, CNBC, NPR and others networks. He is a regular columnist for Kiplinger’s and has contributed articles to The Wall Street Journal, Barron’s, The Financial Times and other national and international news media. Prof. Siegel served for 15 years as head of economics training at JP Morgan and is currently the academic director of the U.S. Securities Industry Institute.

Prof. Siegel is the author of numerous professional articles and three books. His best known, Stocks for the Long Run, which published its fifth edition in 2014, was named by the Washington Post as one of the ten-best investment books of all time. His book,The Future for Investors: Why the Tried and the True Triumph over the Bold and New, was published by Crown Business in March 2005 and was named one of the best business books published in 2005 by Business Week, the Financial Times, and Barron’s magazine.

Prof. Siegel has received many awards and citations for his research and excellence in teaching. In November 2003 he was presented the Distinguished Leadership Award by the Securities Industry Association and in May 2005 he was presented the prestigious Nicholas Molodovsky Award by the Chartered Financial Analysts Institute to “those individuals who have made outstanding contributions of such significance as to change the direction of the profession and to raise it to higher standards of accomplishment.”

Other awards include the Roger F. Murray Prize for best paper presented at Q Group Conferences, 2014, the Graham and Dodd Award for the best article published in The Financial Analysts Journal in 1993 and the Peter Bernstein and Frank Fabozzi Award for the best article published in The Journal of Portfolio Management in 2000.

In 1994 Professor Siegel received the highest teaching rating in a worldwide ranking of business school professors conducted by Business Week magazine and in 2001, Forbes named JeremySiegel.com as one of the “Best Business School Professor” websites.

Prof. Siegel served 15 years as head of economics training at JP Morgan from 1984 through 1998 and is currently the academic director of the U.S. Securities Industry Institute. Prof. Siegel currently serves as Senior Investment Strategy Advisor of WisdomTree Investments, Inc., consulting the firm on its proprietary stock indexes.

Videos

The Future for Investors

Wharton's Jeremy Siegel predicts an imminent pullback

Finance Prof. Jeremy Siegel on Markets & the Fed in 2021 & 2022 | Wharton Business Daily Interview

Speech TopicsExpand each topic to learn more

The notion that falling stocks are penance for an economy built on indebtedness is overblown. There is nothing intrinsic in the world economy that has lost its productivity. Prof. Siegel diagnoses the causes of the current crisis and the prospects for recovery. Jeremy Siegel, a renowned professor of finance at the Wharton School and a regular commentator on major network and cable news and regular columnist for major financial publications encourages investors to take heart. Called the “Wizard of Wharton” and one of the world’s keenest financial minds, Siegel has an unshakable belief that brighter days are ahead for Wall Street. He shares his incredible insights on today’s latest financial news and what is ahead for not only Wall Street, but for investors and business.

As the global marketplace blossoms into a reality, investors need to understand its perils and pitfalls. Is Asia becoming an economic powerhouse, or merely a paper tiger? How do quickly growing countries trap investors into poor returns? Jeremy Siegel gives an overview of what lies ahead for international investors as the borderless economy begins to emerge.

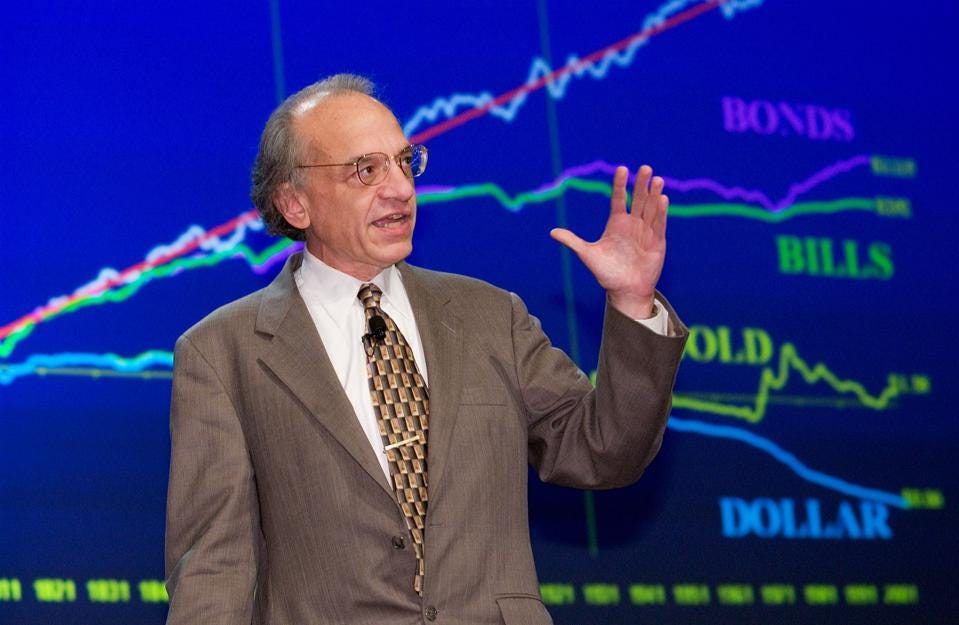

Given the current market, doubt in the soundness of the stock market has crept in among investors. Siegel takes a critical look at current and future earnings of the S&P 500 Index and reviews historical returns and what investors should expect from their investments today.

How should we value stocks in today?s market? What level of PE can current companies justify? Siegel examines warranted price-to-earnings ratios by looking back at the original Nifty-Fifty.

Testimonials

Blog Posts

Seven Archetypes of Success Every High Achiever Must Know

Learn the seven archetypes of success from triple Emmy-winning speaker Gaby Natale and how her Virtuous Circle framework can help you get there.

Read More

Fear Is Your GPS, and Michelle Poler Shows You How to Follow It

Keynote speaker Michelle Poler shares how to navigate fear, take brave action, and build authentic brands in this episode of The Keynote Curators Podcast

Read More

Women’s History Month Keynote Speakers Who Change What Happens Next in 2026

Women's History Month demands more than applause; discover keynote speakers who create recognition that drives real change.

Read More

Keynote Speakers Who Tell Great Stories Get Booked More in 2026

Keynote speakers need more than craft to get booked. Learn the mindset shift that builds sustainable speaking careers.

Read More

Happiness at Work Is the Performance Strategy You Need, with Jessica Weiss

Happiness at work is a performance strategy, not a perk. Learn how Jessica Weiss helps teams build real, sustainable happiness.

Read More

Emotional Intelligence Skills That Hold Up Under Pressure

Emotional intelligence is more than a buzzword. Here's what real EQ looks like under pressure, and the keynote speaking voices building it on stages in 2026.

Read MoreRelated Economy Speakers

Get in TouchContact US

Fill out the form so we can best understand your needs.

A representative from The Keynote Curators will reach out to you.