October 14, 2025Best Leadership Speakers for Financial Services Conferences (2026 Guide)

Planning a bank, fintech, insurance, or wealth management event? This definitive guide to the Best Leadership Speakers for Financial Services Conferences shows you what works now: selection criteria, vetted speaker ideas, comparison snapshots, sample agendas, buying tips, FAQs, and direct links to relevant resources on The Keynote Curators (TKC).

Quick Links

- Leadership Topic Hub

- Best Finance Keynote Speakers

- Economy Speakers

- Blockchain & Cryptocurrency Speakers

- Artificial Intelligence Speakers

- Customer Experience Speakers

- Get Proposal (availability & fees)

If you’re searching for the Best Leadership Speakers for Financial Services Conferences, you’re in the right place.

This guide is built for banking, fintech, insurance, payments, and wealth management planners who need leaders who speak the industry’s language—risk and compliance, customer trust, cost‑to‑income pressure, digital transformation, cyber/fraud, and responsible AI—while delivering clear actions your managers can use on Monday.

We reviewed industry reports, recent finance conference agendas, and common planner questions, then combined that research with TKC’s roster to create a high‑signal, easy‑to‑use playbook you can act on today.

Why this matters now: The financial services audience prizes clarity, credibility, and utility. The best sessions balance strategy with tactical playbooks—leadership behaviors, conversation scripts, and metrics that tie to outcomes like NPS/CSAT, operational efficiency, sales productivity, retention, and risk reduction.

What Planners are Actually Searching For (shaped by real agendas)

When people look up the Best Leadership Speakers for Financial Services Conferences, we repeatedly see these intent themes:

- Future‑ready leadership: leading through rate volatility, regulatory shifts, and digitization (core modernization, cloud, data, payments, embedded finance).

- AI & risk governance: responsible AI, model explainability, bias, productivity gains vs. control environment, and change management for front‑line teams.

- Customer trust & growth: cross‑sell without friction, service excellence, personalization, and human+digital journeys for retail, commercial, and private banking.

- Operational excellence: cost‑to‑income discipline, process redesign, frontline enablement, and sales/servicing alignment.

- Cybersecurity, fraud, and resilience: from identity to payment fraud, and incident communication that preserves confidence.

- People and culture: accountability, inclusion, coaching conversations, and well‑being in high‑stakes environments.

You’ll see those needs reflected throughout this guide—so your content, your speaker selection, and your agenda all match real search intent.

Who This Guide is For

- Banks & credit unions: enterprise leadership meetings, line‑of‑business summits, branch leadership forums.

- Fintech & payments: product, go‑to‑market, and partner summits; customer conferences; SKOs.

- Insurance: distribution leadership meetings, underwriting & claims leadership, field conferences.

- Wealth & asset management: advisor conferences, client events, practice‑management offsites.

- Associations & events companies: national conferences, regional roadshows, virtual/hybrid series.

How We Selected the Best Leadership Speakers for Financial Services Conferences

We prioritized speakers who:

- Have credible proximity to finance (economists, former regulators/executives, behavioral finance experts, fintech founders, cyber leaders).

- Translate leadership into behaviors (playbooks, conversation scripts, cadence for execution), not just inspiration.

- Offer multiple formats (keynote + moderated fireside + workshop + executive roundtable) so ideas become actions.

- Earn repeat bookings and strong ratings, signaling practical value and audience resonance.

Tip: Pair an opening keynote with a moderated panel (executives + customers + risk) to anchor strategy, then add a breakout workshop to create a 90‑day plan with named owners.

Best Leadership Speakers for Financial Services Conferences: Our Top Picks

Order is alphabetical. Click through for full bios, videos, and availability.

- Alice Han — Macro and geopolitics with a focus on China, fintech, and global capital flows. Clear guidance for leaders developing strategies under uncertainty.

Great for: economic outlook sessions, global strategy forums, board updates. - Andrew Busch — Former U.S. government Chief Market Intelligence Officer; turns complex market signals into simple executive actions.

Great for: banking leadership meetings, risk committees, client events. - Jill Schlesinger — Emmy‑winning analyst who makes economic and financial news useful for leaders and clients; superb on stage and in Q&A.

Great for: client conferences, wealth management, and cross‑functional leadership days. - Marci Rossell — Former CNBC Chief Economist; frames growth, rates, inflation, and geopolitics with an executive‑ready narrative.

Great for: C‑suite retreats, investor relations, client briefings. - Mark Tibergien — Financial services operator and advisor‑channel legend; practical leadership for distribution, succession, and profitability.

Great for: advisor conferences, field leadership, practice‑management summits. - Matt Elliott — Banking & sustainability leader; connects strategy, stakeholder value, and execution discipline.

Great for: enterprise leadership days, ESG & growth intersections, transformation PMOs. - Meir Statman — Behavioral finance pioneer; translates investor psychology into better leadership, advice, and risk conversations.

Great for: wealth & asset management, advisor education, risk & compliance culture. - Morgan Housel — Best‑selling author on behavior and investing history; compelling leadership lessons about decision‑making and time horizons.

Great for: client events, leadership inspiration with substance, culture change. - Theresa Payton — Former White House CIO and leading voice on cyber, fraud, and resilience; leadership playbooks for incidents and prevention.

Great for: cyber/fraud leadership, payments, customer trust. - Valerie Red‑Horse Mohl — Finance leader and impact investor; practical DEI, governance, and stakeholder leadership in financial institutions.

Great for: enterprise culture shifts, inclusive growth, community investment. - Dr. Frank Murtha — Investor‑psychology expert; coaches leaders and advisors on bias, trust, and decision quality.

Great for: advisor skill‑building, practice leadership, risk culture. - Nick Leeson — Cautionary (and constructive) perspective on risk, controls, and leadership accountability from the Barings Bank story.

Great for: risk culture resets, audit/compliance conferences, leadership ethics.

Prefer a futurist lens? Pair any of the above with Michael Rogers for a forward‑looking take on technology, customers, and leadership trade‑offs.

Comparison Snapshot (at‑a‑glance)

| Speaker | Finance relevance | Leadership focus | Great for | Formats |

|---|---|---|---|---|

| Alice Han | China macro, fintech, geopolitics | Strategic clarity in uncertainty | C‑suite strategy, board briefings | Keynote • Fireside • Panel |

| Andrew Busch | Markets & policy signals | Decision‑ready narratives for leaders | Risk committees, client events | Keynote • Roundtable |

| Jill Schlesinger | Economic news made useful | Client trust & clarity | Client conferences, leadership days | Keynote • Q&A • Podcast‑style |

| Marci Rossell | Macro, inflation, rates | Story‑driven economic leadership | C‑suite, IR, sales enablement | Keynote • Workshop |

| Mark Tibergien | Advisor channel operations | Distribution leadership & profitability | Advisor/field leadership summits | Keynote • Breakout |

| Matt Elliott | Banking & sustainability | Strategy, stakeholders, execution | Enterprise leadership summits | Keynote • Panel |

| Meir Statman | Behavioral finance | Bias, risk, better decisions | Wealth/asset management | Keynote • Masterclass |

| Morgan Housel | Investing behavior & history | Culture, patience, long‑term thinking | Client events, all‑hands | Keynote • Fireside |

| Theresa Payton | Cybersecurity & fraud | Resilience, incident leadership | Payments, ops, risk | Keynote • Tabletop |

| Valerie Red‑Horse Mohl | Finance & impact | Inclusive leadership & governance | Culture days, ESG | Keynote • Panel |

| Frank Murtha | Investor psychology | Coaching, trust, decision quality | Advisor education | Keynote • Workshop |

| Nick Leeson | Risk accountability | Controls, ethics, lessons learned | Risk, audit, compliance | Keynote • Q&A |

Fees vary by date, location, routing, and format. Use this link to request a precise quote and current availability for your dates.

What “leadership” Means in Finance Right Now

In financial services, leadership lives at the intersection of prudence and progress. Your audience expects speakers to respect the regulatory and risk context while helping them drive growth, simplify processes, and adopt new tools safely. The Best Leadership Speakers for Financial Services Conferences do five things well:

- Make complexity simple without being simplistic.

- Give behaviors, not buzzwords—coaching scripts, cadence, and measurable outcomes.

- Balance offense and defense—growth with risk controls, innovation with governance.

- Model communication that builds customer trust in high‑stakes moments.

- Show how AI and data amplify people, not replace them, with guardrails any leader can use.

Program Design Playbook (so ideas turn into results)

Use this as a plug‑and‑play approach for a bank, fintech, insurance, or wealth leadership day.

- Define the outcome in one sentence. Example: “Regional leaders leave with a 90‑day plan to lift customer satisfaction 5 points while reducing call escalations by 10%.”

- Design for mixed rooms (frontline/ops/risk/sales). Use plain language and examples that cross retail, commercial, and wealth.

- Anchor with a keynote that sets context (rates, economy, tech, regulation), followed by a moderated panel to localize lessons by line of business.

- Add a hands‑on breakout to draft action plans with owners and metrics. Close with an executive roundtable to commit resources.

- Instrument for follow‑through (30‑60‑90‑day check‑ins, dashboards, pipelines, QA calibration, coaching cadence).

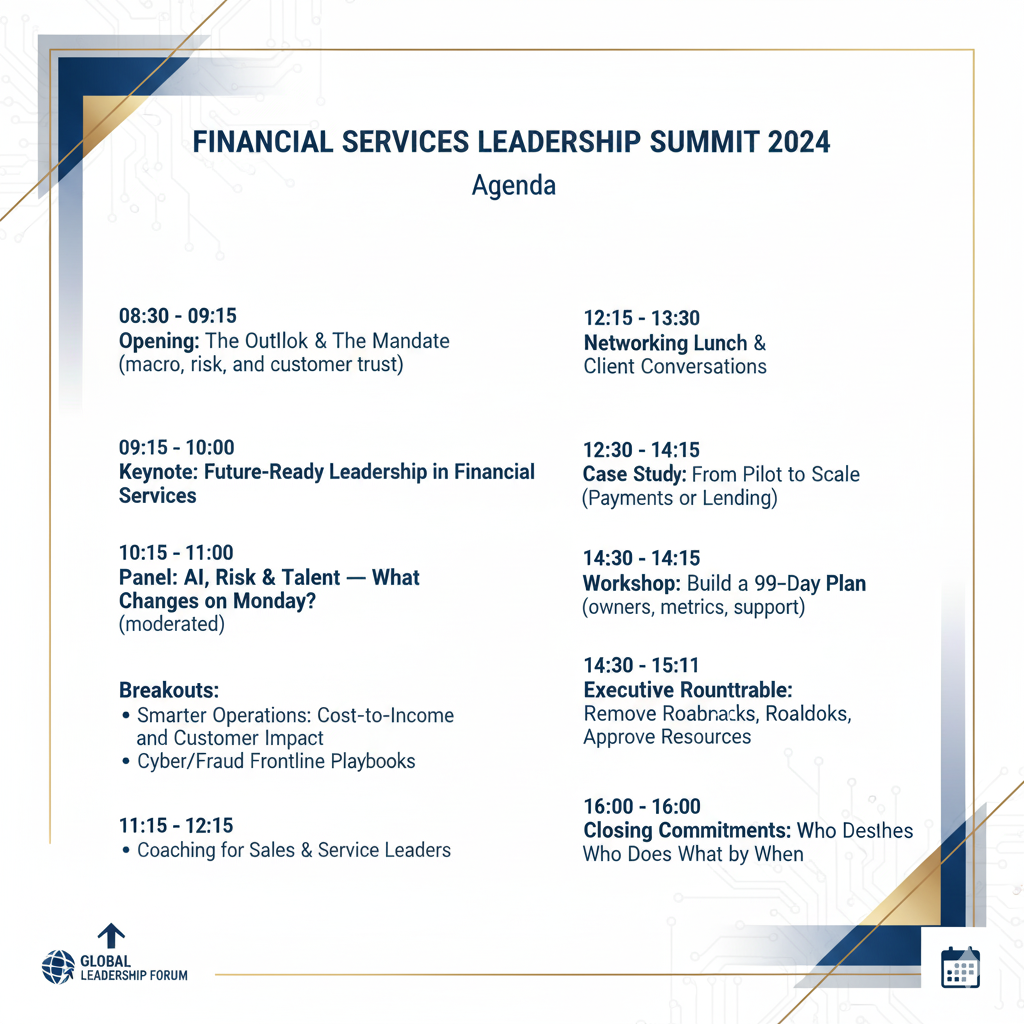

Sample Full‑Day Agenda (Bank or Credit‑Union Leadership summit)

08:30 – 09:15 Opening: The Outlook & The Mandate (macro, risk, and customer trust)

09:15 – 10:00 Keynote: Future‑Ready Leadership in Financial Services

10:15 – 11:00 Panel: AI, Risk & Talent — What Changes on Monday? (moderated)

11:15 – 12:15 Breakouts:

• Coaching for Sales & Service Leaders

• Smarter Operations: Cost‑to‑Income and Customer Impact

• Cyber/Fraud Frontline Playbooks

12:15 – 13:30 Networking Lunch & Client Conversations

13:30 – 14:15 Case Study: From Pilot to Scale (Payments or Lending)

14:30 – 15:15 Workshop: Build a 90‑Day Plan (owners, metrics, support)

15:30 – 16:00 Executive Roundtable: Remove Roadblocks, Approve Resources

16:00 – 16:15 Closing Commitments: Who Does What by When

Need a two‑hour version? Run: 20‑min outlook → 25‑min keynote → 30‑min panel → 30‑min workshop sprint → 15‑min executive commitments.

Buying Guide: How to Secure The Best Leadership Speakers for Financial Services Conferences

- Outcome first: e.g., “Leaders leave with a coaching script for risk‑aware upsell conversations.”

- Audience mix: percentages for retail/commercial/wealth/ops/risk; seniority bands.

- Format mix: keynote + panel + workshop + roundtable; define interaction level.

- Calendar & routing: propose 2–3 date options; ask about nearby holds to optimize travel cost.

- Pre‑brief: share policies, risk sensitivities, internal success stories, and forbidden topics.

- AV & interaction: live polling, open Q&A, table exercises, microphone plan.

- Follow‑through: request a one‑pager of Monday behaviors and a 30/60/90 check‑in plan.

Final word

Choosing the Best Leadership Speakers for Financial Services Conferences is about fit, not flash. Start with your outcomes, match the leader to the audience and the moment, then convert insight into a 90‑day plan. If you’d like a curated shortlist by business line, budget band, and date, we’ll put 3–5 names on hold and return availability within hours—so you can move from planning to impact.

FAQs — Best Leadership Speakers for Financial Services Conferences

What are the typical fees for leadership Speakers for a financial services conference?

Fees vary by profile, date, routing, and format. Share your specifics and we’ll return a precise range.

Can speakers tailor to banking vs. insurance vs. wealth?

Yes. Most customize by line of business and audience seniority; many will run separate sessions for leaders and the frontline.

Do you support virtual or hybrid?

Absolutely. We’ll recommend formats and interaction tools that keep energy high and protect compliance.

Can we add a workshop or executive roundtable?

Yes—and we encourage it. It’s the fastest way to convert ideas into a 90‑day plan with owners.

How far in advance should we book?

3–6 months is ideal for prime quarters. If your window is tighter, we’ll present strong alternatives.

Relevant resources on The Keynote Curators.

- Leadership Topic Hub

- Best Finance Keynote Speakers

- Economy Speakers

- Blockchain & Cryptocurrency Speakers

- Artificial Intelligence Speakers

- Customer Experience Speakers

- Get Proposal (availability & fees)

- The Keynote Curators’ Podcast

Want us to hand‑pick 3–5 Best Leadership Speakers for Financial Services Conferences for your exact dates and budget? Get Proposal and note your line of business, audience mix, and goals.

Discover More Insights

Get in TouchContact US

Fill out the form so we can best understand your needs.

A representative from The Keynote Curators will reach out to you.